Ultimate Guide to Lump Sum Mobility Benefits

Moving employees is a complex and expensive endeavor with companies choosing varying methods of compensation and/or reimbursement to get the job done. The term “Lump Sum” has become popular within the relocation industry in recent years.

Lump sums provide an option to deliver support to a relocating employee while potentially minimizing administrative needs and more predictable anticipated relocation costs. As the job market

begins to tighten, more companies are looking

at different ways to attract and retain top talent. For some, this means viewing relocation packages as possible differentiators to make their firms more competitive. It also means determining which type of relocation packages they should

offer be they full-service relocation programs, lump sum or a combination thereof depending on the employee being moved.

A lump sum approach will not be ideal for some employees, but may provide benefits when appropriately leveraged. In this context, a lump sum will differ from a miscellaneous relocation allowance (a common component of domestic and global relocation

packages). The miscellaneous relocation allowance is provided to the employee to cover incidental relocation costs that are not covered elsewhere in the policy (e.g., pet

shipment or gratuities). In contrast, a lump sum is defined as a cash

payment made to a relocating employee that is intended to cover all or a portion of relocation services that would otherwise be delivered directly to the employee (e.g., reimbursement for final move expenses, cultural training).

What Are The Different Types of Lump Sum Relocation Benefits And How do They Work?

Self Service: The lump sum is provided to the employee in lieu of all benefits and services. 35% of companies use Self Service lump sum where all benefits and services are to be covered by the lump sum payment*. Here,the employee receives the cash lump sum and coordinates their own move and services. The employee receives no support other than the cash payment

Limited Support or Managed Lump Sum: As with Self Service, the employee is provided with a lump sum amount. However, unlike Self Service, the Relocation Provider provides additional support and guidance on how to maximize the lump sum. This may include connecting the employee with preferred suppliers and offering information on how to best coordinate services in conjunction with their timeline. Support can be provided through a relocation counselor or through a technology portal.

Core Benefits: The employer designates certain core relocation benefits to be covered by a lump sum. The lump sum is then provided to assist with these designated core relocation benefits that would have typically been provided through reimbursement, such as:

● Home Finding Trip

● Final Move

● Temporary Housing

● Excess Baggage

● Cultural Training

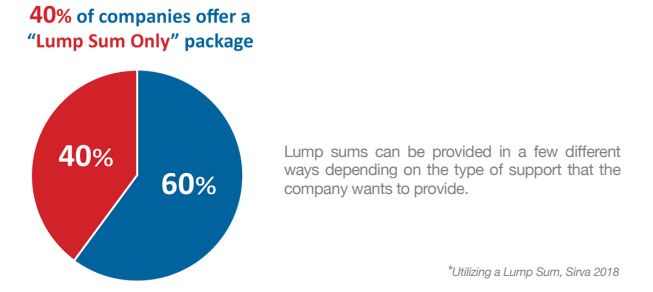

According to recent research*, 40% of firms utilize lump sum for one or more benefit. As with Limited Support or Managed Lump Sum, the Relocation Provider offers guidance on how to maximize the lump sum amount. This may include connecting the employee with preferred suppliers to assist with services and helping them understand how to best coordinate relocation services with their timeline. Support can be provided through a relocation counselor or through a technology portal. Under this method, employers may require employees to submit receipts to ensure funds were spent only on services covered by the designated core benefits.

Flex Benefits: A lump sum can also be used to provide for additional services that may fall outside of a company’s typical core benefits. These benefits are known as, “Flex Benefits” as they provide flexibility to a given relocation program. Flex Benefits might include:

● Family Support

● Spousal Support

● Additional Home Finding Trip

● Return Trip Back to Origin

● Pet Shipment

● Additional Temporary Living

Here too, the Relocation Provider provides guidance on how to maximize the lump sum. This may include connecting the employee with preferred suppliers to assist with services and helping them understand how to best coordinate relocation services with their timeline. Support can be provided through a relocation counselor or through a technology portal.

*As many companies provide a lump sum in more than one way in their relocation program, percentages do not equal 100%.

Questions to Consider When Developing Lump Sum Relocation Benefits:

● When will the employee receive the funds – before, during, or after the move?

● Is the lump sum amount enough to cover all of the expenses?

● If not, what expenses will the company cover?

● What expenses will be the responsibility of the employee?

● What is the employee’s compensation plan or salary level?

● How long has the employee been with the company?

● How many family members will also be moving?

● Is the employee a homeowner or a renter? Will they need to sell their home?

● Will the employee need temporary housing or storage? For how long?

● How far is the employee moving?

● Are they moving to a high-cost area?

How are Lump Sum Amounts Calculated?

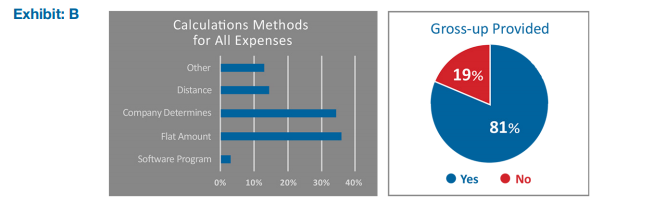

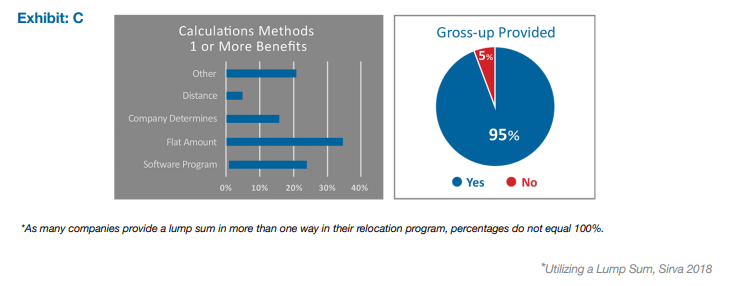

Company determined: The company determines a set amount based on the expected costs for the services they are willing to cover for the employee. According to research*, over 30% of companies calculate the amounts for all of their lump sum benefits this way.

Location: 22% of firms apply predetermined flat amounts for their total lump sum payments based on where the employee is moving to or from*. Some companies base this amount on the employee’s point of origin, whereas others use the destination location.

Flat Amount: Approximately 14% of companies have one flat amount for relocations*. This means that they have predetermined what they are willing to pay to relocate an employee. Regardless of distance or location, employees receive the same lump sum amount to cover their moves.

Distance: The lump sum benefit is calculated based on a set amount for the distance of the employee’s move. Nearly 15% of companies use distance to calculate a lump sum amount for all benefits* by most commonly applying a fixed dollar amount per mile.

Software Program: Some firms opt to use software programs to determine the lump sum amount for some or the total benefits provided to the employee. Data for the employee’s move such as distance in miles, number of family members being moved, and other information is entered into a program that then computes the lump sum amount. Over 20% of companies use a software program to determine the lump sum amount that will be provided to an employee for one or more benefit*.

*Utilizing a Lump Sum, Sirva 2018

Gross-ups are funds provided by the company to offset the tax burden an employee experiences when receiving non-deductible moving income.

What is Lump Sum Intended to Cover?

What is covered in a lump sum benefit varies by company, employee seniority, and other factors. According to recent research* companies utilize lump sum payments the following ways:

● Temporary Housing: 41% of respondents

● Household Goods Shipment: 40% of respondents

● House-hunting trip: 33% of respondents

● Visa/immigration: 12% of respondents

● Tax: 10% of respondents

● Cultural Training: 9% of respondents

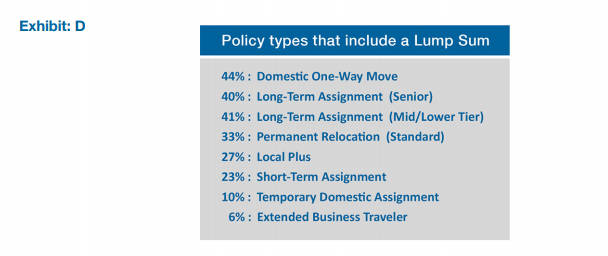

Which Policy Types Include a Lump Sum?

Research shows that companies utilize lump sum payments for some or all of the benefits they provide for virtually all types of relocations. Most commonly however, lump sum is used for domestic one-way moves, long-term assignments and permanent relocations.

How is the Payment Distributed?

A lump sum allowance can be provided to the employee through a regular payroll check, wired to a bank account, or provided on a preloaded company debit card (a great option for new hires not yet on payroll). Some companies may also choose to reimburse an employee for moving expenses, paying for the move after the fact.

Benefits of a Lump Sum Program

It’s Money: Offering a lump sum package is undoubtedly more preferable than making employees move at their own expense. However, additional flexibility may be added to a lump-sum package to increase its ease of use for the business and make it more attractive to the employee. When recruiting and moving younger generations, such as millennials, this can be an important factor.

Keeping it Simple: It’s an easy way for companies to administer expenses and/or the budget process, putting far fewer demands on HR, Procurement, and Accounting. There is no need for the business to document individual expenses or handle a moving company.

Under Control: Lump sum offers company cost controls. A flat or fixed amount makes it easier for employers to manage budgets and takes the guesswork out of determining the final cost of a move.

Clear-cut: Once a lump sum amount is calculated, there may be a reduction in the number of exception requests received.

Challenges of a Lump Sum Program

Attractiveness: A standalone lump sum package without added flexibility or enhancements, might not be the most attractive option to employees if other companies are offering more robust relocation plans.

Culture: A no-frills lump sum package may not be best for fostering a positive company culture. As younger generations are making up more and more of our workforce, the importance placed on company culture is greater than ever because it matters to them. When compounded by the fact that the talent market is increasingly competitive, a standalone lump sum package may not communicate to the employee that they are highly valued by the company.

For more on how corporate relocation influences culture, please visit our blog post, Hidden Messages: What Does Your Relocation Program Say About Your Company Culture?

Mind the Gap: Due to unexpected out-of-pocket expenditures, estimating the total up-front costs can be difficult. For example, an employee may have to cover the difference if a mover’s initial estimate is lower than the actual price of the move. There is an absence of data when tracking actual costs and trends incurred by the employee which may create a gap in coverage.

Allocation of Funds: As with any lump sum program, the challenge is ensuring the employee uses the funds as intended; in other words, to cover relocation expenses. There is no guarantee that the employee will spend the funds in a manner that ensures a smooth relocation, transition and settlement.

More Job Duties: When employees are offered a lump sum, they must play the role of a consumer in the marketplace for a work-related move. This means they will not receive the same pricing and priority as employees of companies contracted with a professional moving and relocation company. This issue is magnified by our current, severe driver shortage. Moving companies will always prioritize a corporate contract over a one time move and with too few drivers available, employees moving as individual consumers may be stuck waiting. Lump sum relocation packages force the employee to play every role involved in today’s modern move – which can be extensive and stressful.

Taxability: Lump sum payments are taxable, where relocation expenses paid by the company on the behalf of the employee may not be depending on a variety of factors such as: move type, destination location, intent of relocation/assignment and/or treaties. Large lump sums (i.e., in lieu of a full program) can impact employees’ tax brackets, which can affect eligibility for financial aid for school-age dependents.

Under Pressure: When employees are busy trying to organize and manage their move (which may include selling a home, finding another place to live, and arranging for movers) it leaves little time to concentrate on doing their job or preparing for a new position. This can result in lost productivity, additional sick or vacation days used to handle the move, and/ or lower morale

How the New Tax Law Effects Lump Sum Payments

Savvy professionals in charge of their company’s relocation programs are also contending with the new changes in the tax law. The recent tax reform impacts relocation programs for both firms and their transferees. While some changes have no direct impact on lump sum, others have implications that may require employers to gross up the amounts given to transferees to cover newly incurred financial burdens. Here are some of the key ways in which lump sum relocation may be impacted:

Elimination of the Moving Expense Deduction: Both the federal and state moving expense deductions have been eliminated under the new tax law. As such, should the lump sum amount not cover all of a transferees moving expenses, the transferee will not be able to deduct nor exclude the uncovered expenses. This may be a point of dissatisfaction for the transferee come tax time. However, not all states are conforming to this new law. Currently, the following states will continue to allow moving expenses to be deductible: Virginia, Pennsylvania, New York, New Jersey, Mississippi, Minnesota, Massachusetts, Kentucky, Iowa, Hawaii, and Arizona. Other states are still assessing where they will fall on the new tax policy, including: Vermont, South Carolina, Maine, California, and Arkansas. As states decide if and how they will apply these new laws, it is crucial to stay informed and consider gross ups depending upon the state an employee will be relocating to.

SALT: For individuals, state and local taxes (SALT) are no longer deductible. For employees moving to locations with higher local or state taxes, this will be an increased financial burden. Again, employers may want to consider grossing up lump sum payments for employees who will find themselves in this situation. For more on how the new tax laws may impact your relocation program, download our 2018 Tax Reform white paper.

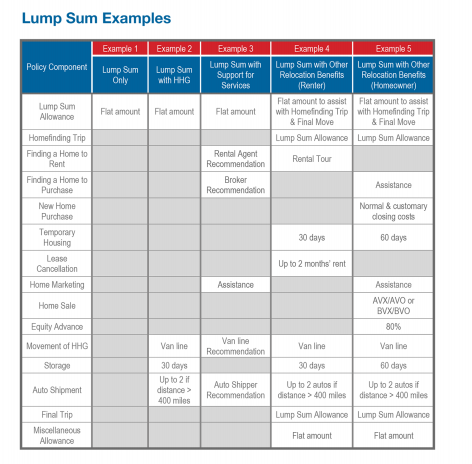

Sample Lump Sum Program: What does a winning lump sum program look like? The sample below shows a tiered approach based on employee seniority and tenure. For entry level to mid-level employees, costs are determined by either a simple calculation method (as shown above) or an amount otherwise set by the employer. Mid-tier and high-tier employees are offered a wider array of covered services and amenities that are often provided by a professional relocation management company with whom the company is contracted.

Conclusions:

Lump sum relocation programs offer companies a simple, streamlined approach to financing employee moves while still containing enough variation to offer choices. Employees benefit from having the funds they need in order to complete their relocation and employers may enjoy the more streamlined, predictable process lump sum can provide.

In evaluating the results of recent research*, it is evident that companies use lump sum in a variety of ways while also applying different calculation methods depending on the benefit. Interestingly, more companies use computer programs for calculating lump sum amounts for specific benefits (over 20%) (Exhibit C) than those who use them to calculate the aggregate lump sum amount (less than 5%) (Exhibit B). This shows us that in some cases companies are customizing certain benefit amounts differently than others which may be due in part to certain benefits being more cost sensitive to factors such as distance, family size, and cost of living. We see similar differences in companies who calculate cost based on distance and those that determine set amounts for benefits. This shows that many companies include various methodologies in determining their lump sum benefit amounts.

Research shows* that while lump sum payments are used broadly across a variety of types of moves, they still only account for one-third of permanent relocations (Exhibit D). This may be due to some of the challenges associated with lump sum relocation such as a lack of attractiveness, taxability or control over how funds are spent by the employee. In examining some of the challenges of lump sum relocation and the additional challenges of today’s landscape (the new tax law and driver shortage), it may give insight into why full service relocation programs remain more popular than lump sum for permanent relocations.

As such, employers should examine not only how their relocation package suits their budgets but also how it stacks up against other firms of their size in their industry. From a company culture standpoint, employers should also examine what their relocation package says about who their company is and whether it demonstrates adequate value placement upon employees. It is also important for those charged with running their firms’ employee relocation programs that they stay abreast of the changes to the tax laws. In so doing, they ensure that they understand what to expect with impending employee moves and how they may need to be prepared to gross up payments to cover newfound financial burdens for transferees and other considerations it may necessitate.

*Utilizing a Lump Sum, Sirva 2018

Click Download Now to download the guide.

Keep up to date on the latest news, industry trends and research regarding domestic and global employee moving and relocation, and commercial moving.

SUBSCRIBE TODAY!

Contact our moving experts now and get started.